Management Discussion and Analysis

OVERVIEW

RCE Capital Berhad ("RCE"), a subsidiary of Amcorp Group Berhad, is an investment holding company listed on the Main Market (previously known as the Main Board) of Bursa Malaysia Securities Berhad ("Bursa") on 23 August 2006. Formerly, it was listed on the Second Board of Bursa on 20 September 1994.

There are three main businesses under RCE and its subsidiaries ("the Group"):

| • Consumer financing, our core business | — RCE Marketing Sdn Bhd and its subsidiaries |

| • Processing and administration of payroll collection | — EXP Payment Sdn Bhd | • Commercial financing | — RCE Factoring Sdn Bhd |

RCE Marketing Sdn Bhd

RCE Marketing Sdn Bhd ("RCEM") and its subsidiaries ("RCEM Group") act as financiers and total solutions provider of cooperatives and/or foundations to provide Islamic consumer financing products for civil servants. The monthly repayments from customers are through direct salary deduction via Accountant General's Department of Malaysia ("AG") and Biro Perkhidmatan Angkasa ("ANGKASA").

RCEM Group is the main contributor of the Group representing 97.2% of the Group's total revenue of RM245.9 million.

EXP Payment Sdn Bhd

EXP Payment Sdn Bhd ("EXP"), a direct subsidiary of Strategi Interaksi Sdn Bhd, ventured into the payroll collection segment in 2014. EXP provides collection services to payroll deductions of government departments under the purview of AG.

RCE Factoring Sdn Bhd

On 4 January 2007, the Group acquired AMDB Factoring Sdn Bhd to complement the Group's personal financing business, which was then renamed as RCE Factoring Sdn Bhd ("RCEF").

RCEF offers commercial financing to small and medium-sized enterprise via factoring and confirming facilities.

Strategy

Apart from emphasis on quality loans growth, the Group focuses on service delivery in expanding its consumer financing base. This includes swift turnaround time, distribution channel management and risk-based product pricing.

Given the ongoing digital evolution, the Group has since invested in digital capabilities for innovative applications and embarked on process simplification to further enhance operational efficiencies.

SUMMARY OF GROUP FINANCIAL PERFORMANCE

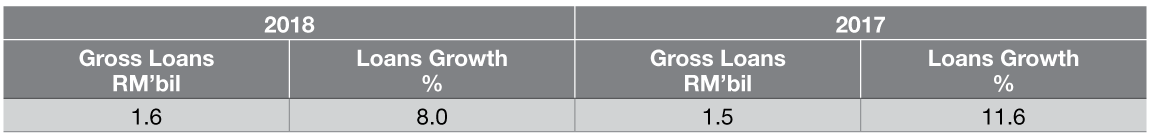

The Group's revenue for the financial year ended ("FYE") 2018 rose to RM245.9 million, representing an increase of 10.1% from RM223.3 million in FYE 2017. The increase was primarily backed by stable growth in the consumer financing loan base, giving rise to RM212.6 million interest income as compared to RM188.8 million in the previous financial year. As our market share in consumer financing remains steady, we have expanded our consumer financing loan base from RM1.5 billion in FYE 2017 to RM1.6 billion in FYE 2018.

With the increase in borrowings from RM1.2 billion to RM1.3 billion, interest expense has risen by RM7.9 million from RM61.4 million to RM69.3 million in FYE 2018. Notwithstanding that, the Group maintained its cost of funds at a reasonable level by actively managing and diversifying its funding pool comprising both fixed and floating rates. Accordingly, Bank Negara Malaysia's ("BNM") increase in the Overnight Policy Rate ("OPR") by 25 basis points on 25 January 2018 has not significantly impacted the Group's cost of funds.

Meanwhile, the Group's non-core income increased from RM9.8 million to RM11.7 million in the current financial year, mainly arising from higher deposit income partially offset by higher base effect from a one-off gain on disposal of investment property in the previous financial year and lower loan recovery.

The Group's prudent cost management saw a dip in operating expense from RM43.1 million to RM41.3 million in FYE 2018.

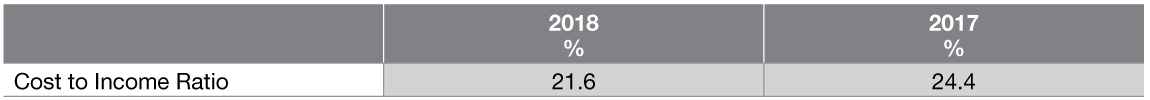

Improvement in net income as well as lower operating expense has led to a lower cost to income ratio from 24.4% to 21.6% for the Group.

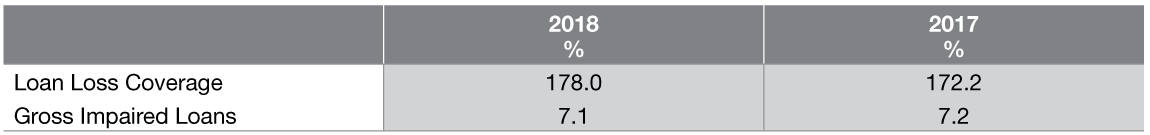

Echoing our stand in sound credit risk management practices, the Group maintained a vigilant level of provisioning giving rise to the higher loan loss coverage of 178.0%. This facilitated the Group's preparation for more forward looking provisioning required by Malaysian Financial Reporting Standards 9 which came into effect on 1 April 2018. Meanwhile, gross impaired loans remained fairly stable at 7.1%, reflecting the Group's stable loan quality as supported by the recent rating review referenced in page 17.

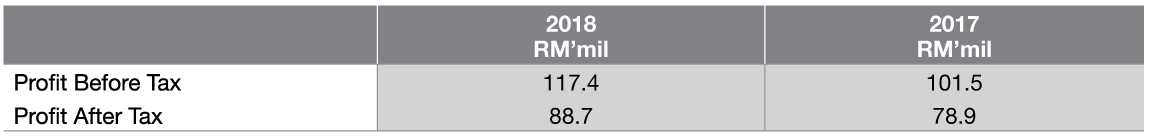

Correspondingly, the Group attained a higher profit before tax ("PBT") of RM117.4 million, representing a 15.6% improvement from RM101.5 million in FYE 2017. The Group has maintained its PBT above RM100.0 million for two consecutive financial years.

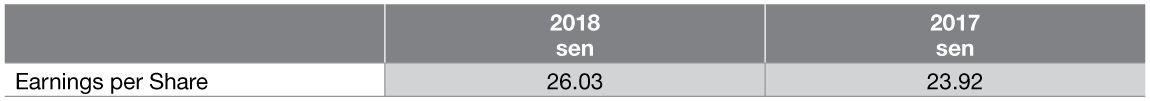

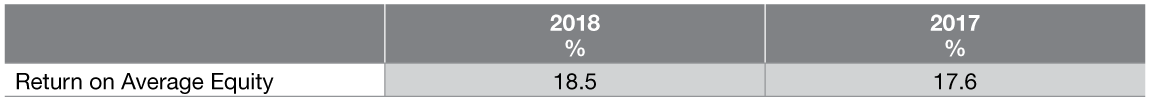

The Group also recorded a higher profit after tax ("PAT") of RM88.7 million in FYE 2018, a 12.3% growth from RM78.9 million in FYE 2017. This translates into higher earnings per share of 26.03 sen and a return on average equity of 18.5%.

BUSINESS OPERATIONS REVIEW

Consumer Financing

In FYE 2018, the Group's core business registered a 10.4% increase in revenue, from RM221.8 million in FYE 2017 to RM244.8 million in the current financial year, mainly contributed by higher interest income. Loans growth moderated to 8.0% as compared to 11.6% in the previous financial year arising from a stricter lending environment and larger loan base. Nevertheless, this business segment produced a 15.5% increase in PAT from RM78.1 million in FYE 2017 to RM90.3 million in FYE 2018.

Loan quality is managed through a comprehensive evaluation of an applicant's credit via a credit scoring model. Regular reviews ensure credit practices and scoring models remain effective and relevant while asset quality is monitored to remain at a manageable level. Riskier credit will be matched with higher priced products.

The Group motivates its distribution channel by offering attractive incentive and remuneration to its marketing representatives, supported by on-going marketing and promotion initiatives. They are tasked to maintain professionalism as guided by the Code of Conduct while the Group provides appropriate training programmes to sharpen their competencies and to heighten their awareness on regulatory requirements.

Consumer financing will remain the primary contributor to the Group's profitability as we commit to continue providing speed, quality service and better customer experience.

Investment Holding, Management Services and Others ("IHMSO")

The Group's IHMSO segment reported RM1.1 million in revenue for FYE 2018 as compared to RM1.5 million in the preceding financial year, following the Group's cautious approach in its factoring and confirming business.

This segment recorded a PAT of RM0.8 million in FYE 2017 as compared to a loss after tax of RM1.6 million in FYE 2018. Excluding the effects of a RM2.1 million write back of allowance of impairment loss on receivables in the previous financial year, this segment's underlying loss after tax was RM1.3 million in FYE 2017.

This segment's financial performance is consistent with the Group's intention to shrink its commercial financing arm and focus on recovery of non-performing loans.

Moving forward, this segment's contribution to the Group's performance will remain marginal.

LIQUIDITY RISK MANAGEMENT

The Group adopts prudent liquidity risk management that includes cash flow monitoring to ensure all funding requirements are met, matching of maturity profile of its assets against liabilities and active diversification of funding pool to keep its cost of funds at a reasonable level.

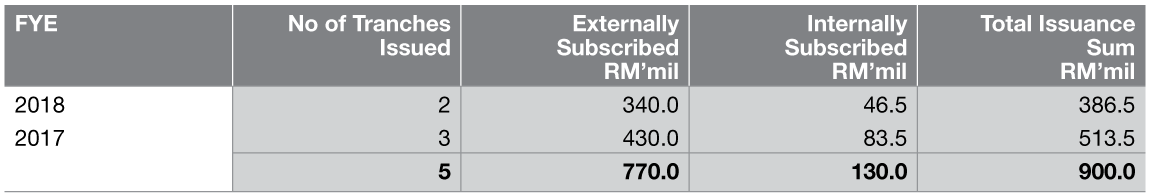

To complement the Group's plan in improving its liquidity risk management, a Sukuk Murabahah Asset-Backed Securitisation Programme of up to RM900.0 million ("Sukuk Programme") via a special purpose vehicle, Al Dzahab Assets Berhad ("ADA") was set up to acquire pools of eligible loans originated by RCEM in FYE 2017. This was the Group's fourth foray into the debt capital market.

To-date, the Sukuk Programme amounting to RM900.0 million has been fully issued. Of the RM900.0 million, RM770.0 million was taken up by external parties and the balance RM130.0 million was internally subscribed by a subsidiary, RCE Trading Sdn Bhd:

In addition to the market's interest in subscribing to the issuance, the Sukuk Programme had previously garnered three awards, "Best Murabahah Deal of the Year 2016 in Southeast Asia" by Alpha Southeast Asia Deal & Solution Awards 2016 on 25 January 2017, "Commodity Murabahah Deal of the Year 2016" by Islamic Finance News Awards 2016 on 22 February 2017 and "Best Securitisation Sukuk of the Year 2017" by The Asset Triple A Islamic Finance Awards 2017 on 11 July 2017.

On 13 February 2018, ADA was further awarded "Best Asset-Backed Securitisation Deal of the Year 2017 in Southeast Asia" by Alpha Southeast Asia Deal & Solution Awards 2017.

In addition, RAM Ratings Services Berhad, the rating agency for the Sukuk Programme, has also recently upgraded the rating for Tranche 1 Class B Sukuk from AA3 to AA1 and for Tranche 2 Class B Sukuk from AA3 to AA2. The upgrading was on the premise that our securitised portfolio is showing a better than assumed default performance. This translates into better credit support and reiterates our strength in active management of our loans portfolio.

Consequently, arising from the conversion of its short-term borrowings into long-term borrowings, the Group has turned its balance sheet from net current liabilities of RM282.2 million a year ago to a net current assets of RM24.1 million, as at 31 March 2018. This is a commendable achievement while maintaining the Group's borrowings at RM1.3 billion, which is less than three (3) times gearing as at 31 March 2018.

Moving ahead, we will actively explore new funding opportunities for more favourable financing rates for business growth. As it is, the Group is in the midst of securing new funding via a RM2.0 billion Asset-Backed Securitisation Islamic Medium Term Notes Programme.

CAPITAL MANAGEMENT/INVESTMENTS

Sound financial position is essential to enable the Group to continue to create value. The Group's capital management remains robust and aligned to business strategy and regulatory requirements, ultimately protecting the interest of stakeholders.

In FYE 2017, the Group completed its share consolidation and capital repayment exercise to attain a more efficient capital structure. The gearing ratio is now more reflective of the business strategy, which remains stable at 2.1 times.

Transformation is vital to drive growth opportunities and remain up to date on regulatory requirements. As at 31 March 2018, RM4.6 million has been injected into technology to embrace digitisation. Another RM6.8 million is being allocated for further enhancements in the new financial year.

In view of the increasing cyber security threats, the Group stays abreast of latest development to enhance system integrity. The Group also engages professional consultants to carry out penetration tests periodically to ensure our operations are not impacted.

OUR PEOPLE

Great importance is placed in human capital development and talent management. The Group continuously seeks the right people, knowledge, skill sets and expertise to maintain a constant pool of talents. The Group has a workforce of 176 employees as at 31 March 2018.

Developing our talent

The Group nurtures its talents by providing on-the-job training and personal coaching for their jobs supplemented by a suite of comprehensive training programmes delivered in-house or via qualified external trainers. Technical trainings, ranging from regulatory changes to accounting implications, are offered to employees to stay abreast on the latest developments in the industry and remain ahead in today's fast-paced environment.

In relation to career progression, the Group recognises the importance of talent management and provides equal opportunities to driven individuals. Employees who have shown potential are coached by their superiors. Soft skills trainings such as leadership and organisational skills are not overlooked to groom future leaders.

To reward employees for their contribution, the Group practices a performance based remuneration system centered on key performance indicators. Employees who have proven their mettle are invited to participate in the Employees' Share Scheme, in appreciation of their effort, drive and perseverance towards the Group's objectives and financial performance. In FYE 2018, the Group granted a total of 9,137,000 share options to its eligible employees with a charge to profit and loss amounting to RM3.1 million.

Caring for our people

The Group actively encourages employees to pursue a healthy lifestyle and manage stress positively. We care for our employees' health and safety with the introduction of a variety of health and wellness programmes during the financial year such as health workshops, health screenings, annual influenza vaccination and first aid courses. The Group has also provided air purifiers and weekly distribution of fruits to foster a healthier workplace.

In respect to work-life blending, employees can take advantage of our weekly zumba, yoga and badminton sessions. Some fun and recreational workshops such as gift wrapping, soap making and terrarium workshops were also well received. Team-building activities including treasure hunt, bowling and paintball competitions keep our work force motivated, productive and energised.

We remain invested in our human assets as we cultivate and build core talents for the long-term partnership between the Group and our employees.

Dividend

On 13 October 2017, the Group won the "Best in Dividend Yield" award presented by Focus Best Under Billion Awards 2017.

"Best in Dividend Yield" award presented by Focus Best Under Billion Awards 2017

An interim single-tier dividend of 3.0 sen per share on 342,011,911 ordinary shares with a total payout of RM10.3 million was paid to shareholders on 30 January 2018.

Subject to shareholders' approval, the Board of Directors is proposing a final single-tier dividend payment of 4.0 sen per share. Together the Group would have paid a total dividend of 7.0 sen per share for FYE 2018, up 4.0 sen per share as compared to FYE 2017.

The above encapsulates our aim in consistently paying dividends to shareholders. Nevertheless, the Group continuously seeks to strike a balance rewarding shareholders and channeling funds for business growth to ensure long-term sustainability of dividends to shareholders.

Arising thereof, the Group will henceforth be guided by a dividend payout ranging from 20.0% to 40.0% of the PAT.

OUTLOOK FOR 2018/FYE 2019

The Malaysian economy as measured by Gross Domestic Product ("GDP") expanded commendably in 2017 by 5.9% as compared to 4.2% in 2016, supported by private consumption and demand recovery in the external sector. However, headline inflation picked up to 3.7% in 2017 from 2.1% in 2016. On the back of a stronger Ringgit Malaysia against the US Dollar and stable oil and commodity prices, inflation is envisaged by the monetary authority of Malaysia, BNM, to be at 2.0% - 3.0% in 2018. BNM raised the OPR by 25 basis points to 3.25% on 25 January 2018 as global and domestic economic conditions support such a hike to mitigate the rising risk of inflation in Malaysia.

As highlighted in EY's FinTech Adoption Index, consumers are drawn to Financial Technology ("FinTech") services because propositions are more convenient, transparent and readily personalised. Technology is undoubtedly a critical tool that can help financial institutions ("FI") to tailor better products and deliver improved customer experience. As such, more FIs are investing in customer technology focused on front-end interfaces today in order to bridge the gap and stay relevant in a rapidly changing environment. The rise of FinTech in Malaysia was tremendous, especially in 2017 after BNM introduced the FinTech Regulatory Sandbox Framework in October 2016.

While remaining vigilant of the digitalisation in the financing industry, the Group continues to focus on streamlining its operational, distribution channel and risk management infrastructure to elevate operational efficiencies and customer experience. In FYE 2018, a new online platform has been launched to streamline our distribution channel. This is expected to improve customer experience and reach in this ever evolving landscape. In this respect, the Group is actively looking for opportunities in technological enhancement and process simplification as we arm ourselves with tools to remain competitive.

Last but not least, we will continue to be mindful of good sustainability practices and endeavor to practice our sustainability efforts across the Group.

Copyright © 2026 RCE Capital Berhad | All rights reserved.